“As of 30 April 2017, the net asset value of the Sub-Fund was US$3,596,743 and it is not expected to grow in the near future,” the Hong Kong asset management firm stated in its letter to unitholders. The firm has ceased new subscriptions for the fund and will terminate the product in September.

Launched in 2006, the fund was managed by Mihail Dobrinov and Alan Xi Wang. It had ongoing annual charges of 3.12%.

The BRIC acronym – Brazil, Russia, India and China – was suggested by the then Goldman Sachs economist Lord O’Neill in 2001. The investment thesis based on parallel growth of these economies has since fallen apart with the political turmoil in Brazil and Russia’s economy suffering from low oil prices, while India and China are pushing ahead.

Yet there are still eight BRIC-themed funds, including two ETFs, available for sale in Hong Kong and Singapore, according to FE. The largest of them, the Schroder ISF BRIC (Brazil, Russia, India and China) Fund, had $875m of assets under management at the end of June.

Country weighting of the MSCI BRIC Index

| April 2010 | June 2017 | |

| Brazil | 33.65% | 14.25% |

| Russia | 13.40% | 6.80% |

| India | 16.44% | 18.94% |

| China | 36.51% | 60.01% |

Source: MSCI

Three other funds lost authorisation for retail sales in Hong Kong last month, according to the Securities and Futures Commission. They are the Baring Emerging Markets Debt Local Currency Fund, St. James’s Place Ethical Unit Trust, and the RHB ASEAN Navigator Fund.

The Baring Fund was terminated in May, after the merger between Baring Asset Management and Babson Capital Management “due to its small asset size”, according to the firm’s statement. Barings also liquidated its Asian Debt Fund last year.

The RHB fund was launched in 2014 in the SAR and had about $1m of assets under management a year ago, according to the fund’s factsheet.

The asset management arm of Malaysia-based RHB Investment Bank Berhad has another fund registered in Hong Kong, the RHB Islamic Regional Balanced Fund, according to FE.

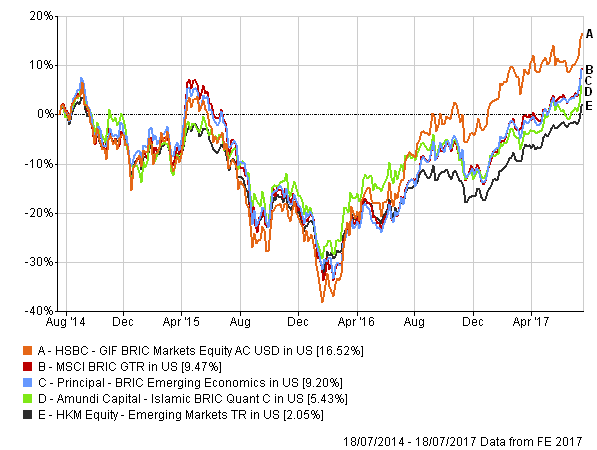

Three-year performance of the three BRIC-theme funds available for sale in Hong Kong and Singapore.

The chart shows the best and the worst performers, as well as the to-be-closed Principal fund. They are compared to the reference MSCI BRIC Index benchmark, and to the average of the emerging market equity funds in Hong Kong.

Source: FE

All fund NAVs have been converted to US dollars. Note that funds in this chart may be denominated in currencies other than the US dollar.