Published by Bloomberg – 19th July 2017

China’s banking regulator told some lenders to lower the rates they offer on wealth-management products, people familiar with the matter said, as officials move to reduce financial risks and stimulate the economy.

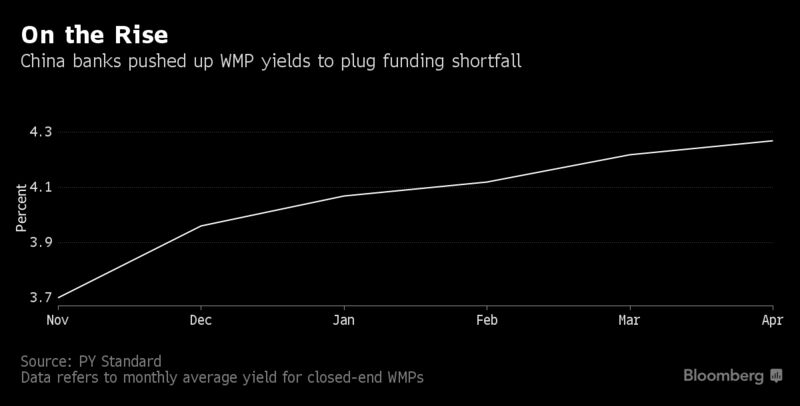

Lenders had pushed WMP yields to a 17-month high in an effort to offset a funding squeeze caused by China’s campaign against leverage. Chinese regulators are concerned that some banks may be passing on the higher funding costs to their borrowers, potentially threatening economic growth and stoking inflation.

China “is reluctant to close the taps for funding in the economy through risky off-balance sheet products, but as a compromise is ‘asking’ banks to lower the interest rates on them,” said Andrew Collier, an independent analyst in Hong Kong and former president of Bank of China International USA. “It is another clever way to try to reduce risk in the economy without shutting off credit.”

Financial and economic stability were key messages expressed by officials attending a once-in-five-year work conference last weekend. China is grappling with how to ensure annual growth of at least 6.5 percent this year, while reining in financial sector risks ahead of a leadership transition this fall at the 19th Communist Party Congress.

The CBRC didn’t immediately respond to a request for comment on the WMP move, while shares of banks declined Tuesday on concern lower product rates would weaken their funding bases. China Merchants Bank Co. fell as much as 4.3 percent in Shanghai, while Chongqing Rural Commercial Bank Co. lost 4.2 percent in Hong Kong.

“The regulators’ aim is for banks to start investing in lower-yield, safer investments, partially removing the risky element,” said Jonas Short, who heads the Beijing office of Sun Hung Kai Financial. “For funding costs, this is likely to affect small and medium-sized banks, as they rely on WMP issuance for deposits, more so than the large deposit-taking banks.”

Following the government’s renewed drive to curb leverage, banks pushed the average returns on WMPs to an annualized 4.66 percent by the end of June, the highest level in at least 17 months, data from Chengdu-based PY Standard showed.

Those yields eclipse the nation’s benchmark one-year deposit rate of 1.5 percent and have helped WMPs become an increasingly bigger source of bank funding. The amount of WMPs held by Chinese banks had grown to 29.1 trillion yuan ($4.3 trillion) as of December, about 80 percent of which resided off their balance sheets, according to CBRC data.

The on-balance sheet WMPs being targeted by the CBRC’s latest move are principal-guaranteed products, meaning banks are obliged to repay investors in full upon maturity.

Disorderly Exit

In curbing the yields on those products, the regulator is attempting to head off any potential for banks to transmit higher funding costs to borrowers, especially smaller Chinese companies that are already struggling to access loans. The average corporate borrowing rate rose to 5.53 percent in March, up 0.26 percentage points from December, latest available central bank data show.

The risk of pushing down returns is that the move may trigger a disorderly exodus of funds from the products, said Michael Every, head of financial markets research at Rabobank Group in Hong Kong.

“It looks incredibly dangerous to me,” Every said. “WMPs offer rates that are unsustainable, true. But by reducing those rates, if people don’t choose to put cash in to them, then the whole pyramid topples over.”

The opacity of some of the products’ underlying assets and their complicated structures through layers of non-bank financial institutions will lead to a chain reaction and exacerbate market volatility when risks emerge, the central bank said in its 2017 financial stability report.