Published by Bloomberg – 6th Sep 2017

Asia’s highest-yielding bonds are holding on to their fans, with top investors saying they’ll keep buying Indian and Indonesian debt — even if policy makers don’t keep easing.

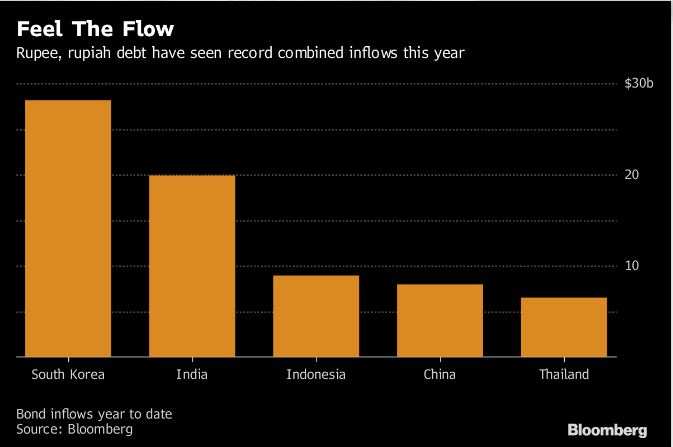

Rupee and rupiah-denominated bonds lured a record $29 billion of inflows this year, with central banks in India and Indonesia reducing key interest rates amid lackluster inflation and subdued growth. While swaps traders don’t see India cutting again this year and economists are mixed on the rate outlook for both countries, firms like Mirae Asset Global Investments Co. and Schroder Investment Management Ltd remain bullish on debt that offers the highest yields in Asia.

“In a stable global environment with the world’s four major central banks very cautiously removing post-crisis unorthodox monetary policies thanks to low inflation, investors will continue to look for yield,” said Rajeev De Mello, head of Asian fixed income at Schroder, which oversees $543 billion globally.

Yields that are about twice that of regional peers, along with economic reforms, have helped rupee and rupiah bonds reel in the cash this year. South Korean bonds saw the most inflows at $28.2 billion amid that nation’s own issues with price growth and expansion rates.

But combined, India and Indonesia are in front. Their debt has drawn in $19.9 billion and $9 billion respectively in 2017, even as developed-nation central banks pivot toward tightening and the Federal Reserve looks to trim its $4.5 trillion balance sheet, a shift that could potentially lure investors away from emerging Asia.

While benchmark rate cuts have helped — both countries eased last month — some economists now see India and Indonesia in holding patterns, so positive economic factors are what’s keeping investors like Schroder in these markets.

Inward Economy

India’s local bonds are Mirae Asset Global’s top pick, regardless of interest-rate factors, says Kim Jinha, the firm’s Seoul-based head of global fixed income.

“It’s really important to distinguish what really drives foreign investors into the Indian debt market,” said Kim, who believes India will cut again this year. “It has a large inward-looking domestic economy, which is doing quite well and is also most likely to fare better in the times of global turmoil.” India also “has a stable political atmosphere which a lot of high-yielding countries lack.”

While Indian expansion took a hit last quarter, economists expect real gross domestic product growth to bounce back in the three months to Sept. 30, and break back above 7 per cent in the fourth quarter, according to estimates compiled by Bloomberg. In Indonesia, an uptick in government infrastructure spending and a tax overhaul is seen keeping annual growth above 5 per cent through next year, even if President Joko Widodo’s target of 7 per cent now seems out of reach.

Chong Jiun Yeh, the Singapore-based chief investment officer for fixed income and structured investments at UOB Asset Management Ltd., which oversaw $23.8 billion at end-July, favors both Indonesian and Indian debt.

“We continue to see improvements in India and Indonesia’s structural reforms, with the authorities addressing the economic imbalances,” he said. “There is more room for bond prices to perform better.”

Meanwhile, there are still those who, like Mirae Asset Global, are holding out for more rate cuts. Axis Bank Ltd.BSE 0.61 %, ING Groep NV and Standard Chartered Plc are forecasting more easing in India after consumer-price inflation sank to an unprecedented low of 1.46 per cent in June. The Reserve Bank of India has a medium-term inflation target of 4 per cent.

Eric Stein, co-director of global fixed income at Eaton Vance Corp. in Boston, also sees Bank Indonesia cutting “one or two more times” as long as the rupiah is stable. Bank Indonesia Assistant Governor Dody Budi Waluyo said last month that there is room for further easing as price pressures this year and in 2018 are likely to remain manageable, or even lower than expected.

“We are still positive on Indonesian local bonds because of the stable macro story and a generally favorable market environment,” said Stein, who didn’t provide a timeframe for his expected rate cuts. “The biggest risk right now is that growth in Indonesia hasn’t picked up as much as other countries, as Jokowi’s de-regulatory efforts have been blocked or marginalized.”